By Tim Estin with Mason Morse Real Estate

About this Report

About this Report

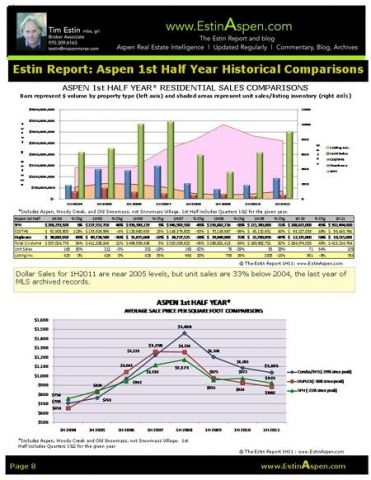

The Estin Report on Aspen Snowmass real estate encompasses sales and market activity for the upper Roaring Fork Valley - Aspen, Snowmass Village, Woody Creek and Old Snowmass - during 1st and 2nd Quarters 2011 and 1st Half 2011. Included property types are single family homes, condos, townhomes, duplexes and residential vacant land sold at prices over $250,000. Fractionals are not included. The report compares the 1st half of 2011 to the 1st half of 2010, historical first half of the year comparisons since 2004 and prior quarter and prior year quarter comparisons. (The source data is the Aspen/Glenwood MLS.)

Brief Summary

The 1st Half 2011 shows a dramatic increase in activity year over year. Sales performance for the first half of this year continues to substantiate the trend of increased Aspen Snowmass real estate activity across the board.

In general, market prices have reset to a post-crisis level, off on average 25-40% from the market peak, but much depends on the property, unique circumstances and seller motivation. Prices continue to be under at least incremental pressure assuming they are at the “new norms” and deal-making and haggling are a dominant part of the transactional process. It’s not pleasant but it is business as usual these days.

The Aspen market has turned most significantly in the central Aspen core and West End and expanding outwards like ripples in a pond. Specifically:

- The ultra luxury Aspen home market – properties closing over $10M – is up 175% (11 sales) in 1H 2011 versus (4) sales in 1H 2010.

- Aspen home sales in 1H 2011 are up 45% in units sold and up 41% in dollar sales over the same period last year;

- Aspen condo sales are up an even more impressive 48% in dollar sales volume and 67% in unit sales.

- In 1H2011, 48% of Aspen home sales sold for less than $4M, whereas in 1H 2010 32% of Aspen home sales were in the under $4M category. This illustrates two points: 1) The fall in prices in past 2 years - what used to cost $5M, now costs $3M-4M; 2) Buyers are in fact stepping up to take advantage of this pricing reset.

The Snowmass Village market has performed much better this half year than last, but the environment remains immensely challenging with continued uncertainty caused by the pending Base Village foreclosure sale. Snowmass prices continue to deteriorate with the exception of high end, fantastic ski-in/out properties which are maintaining premium values.

- Snowmass condo sales of Snowmass doubled from 16 to 32 (100%) in 1H 2011 year over year and dollar volume increased from $19M to $30M (56%)

- Snowmass single family homes saw double digit growth of 19% in dollar sales ($64M to $80M) and 25% in unit sales (12 to 15 sales) from 1H 2010 to 1H 2011.

Yet even as Aspen and Snowmass Village activity has substantially increased since the “transactional bottom” in the first half of 2009 as evidenced then by the least number of unit sales and lowest dollar sales volume since the Crisis began, it remains unclear the extent to which we have in fact reached a bottoming of prices.

Are we still falling or are we scraping along a bottom? There are a number of reasons for uncertainty…

Go to full summary, key findings and complete report

Disclaimer: The statements made in The Estin Report and on Tim Estin's blog represent the opinions of the author not Mason Morse Real Estate. They should not be relied upon exclusively to make real estate decisions. A potential buyer and/or seller is advised to make an independent investigation of the market and of each property before deciding to purchase or to sell. To the extent the statements made herein report facts or conclusions taken from other sources, the information is believed by the author to be reliable, however, the author makes no guarantee concerning the accuracy of the facts and conclusions reported herein. Information concerning particular real estate opportunities can be requested from broker Tim Estin at 970.920.7387 or by email.

The Estin Report is copyrighted 2011 and all rights reserved. Use is permitted subject to the following attribution: "The Estin Report: State of the Aspen Market, By Aspen broker Tim Estin, mba, gri, www.EstinAspen.com"