In the first quarter of 2010, Atlanta single family home sales rebounded from 10-year lows established last year but the local housing market remains challenged by changes to appraisal guidelines, a lack of sales comps for non-distressed properties, and the negative equity situations in which many homeowners find themselves.

Metro Atlanta home sales were up 7% in the first quarter of 2010 from the same quarter a year ago, while sales among the Beacham Bellwethers, an index of metro Atlanta’s 10 most affluent communities, were up 43%. Bellwether neighborhoods such as Buckhead, which was up 41% in the first quarter, were among the last to feel the effects of the housing market crash and are recovering faster than the rest of the market. Other Beacham Bellwether areas where sales have bounced back by 40 percent or more in the first quarter are Alpharetta, Dunwoody, Sandy Springs, and Vinings.

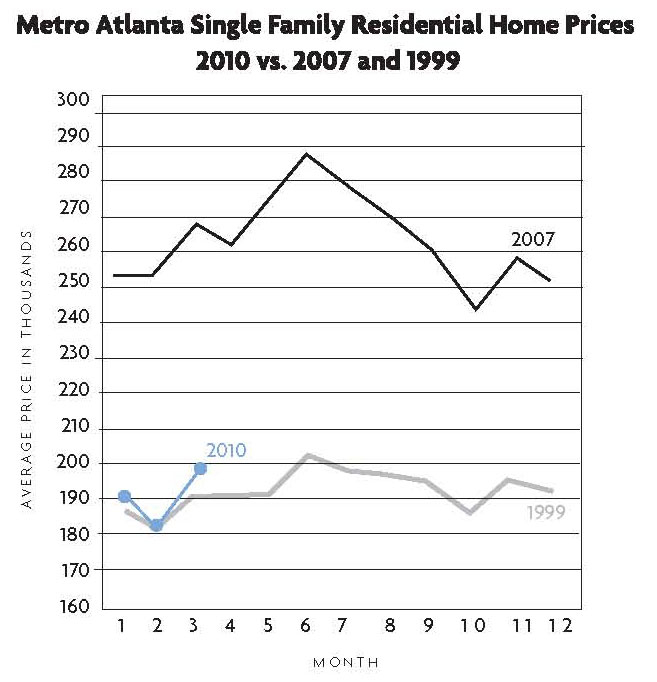

Single family home prices in metro Atlanta were up 6% in the first quarter, but are still down 26% from 2007. Prices in the Beacham Bellwether index were up just 1%, but home prices in the Bellwether areas never dropped as much from 2007 peaks (-15% for the Bellwethers vs. -26% for metro Atlanta). The weakness in prices continues to be driven by short sales and foreclosures, which, by most estimates, represent a third of all homes currently sold.

Single family home prices in metro Atlanta were up 6% in the first quarter, but are still down 26% from 2007. Prices in the Beacham Bellwether index were up just 1%, but home prices in the Bellwether areas never dropped as much from 2007 peaks (-15% for the Bellwethers vs. -26% for metro Atlanta). The weakness in prices continues to be driven by short sales and foreclosures, which, by most estimates, represent a third of all homes currently sold.

The implementation of new government regulations on how appraisals can be conducted has also hampered the real estate market of late. The new guidelines, part of the Home Valuation Code of Conduct (HVCC) implemented by the federal government last year, require appraisers to be randomly chosen and prevent home buyers, lenders, and real estate practitioners from being involved in the selection process. The unintended consequences of the new guidelines are wide variations in appraised values because appraisers are being assigned appraisals in areas of Atlanta that are unfamiliar to them.

Appraisals have also become more open to interpretation due to a lack of sales and the elevated level of distressed sales, which are not representative of market value. Contract prices that are higher (in some cases much higher) than the appraised value are becoming more common. In fact, current appraisal conditions are virtually the opposite of the conditions that existed prior to the implementation of the HVCC when an appraiser could virtually substantiate any contract price.

Lenders’ aversion to reasonable risk is another factor affecting appraisals right now. Recently, an independent appraiser valued a Buckhead home at $3.2 million but when the appraisal was reviewed by the lender’s underwriting department, the value was reduced to $2.8 million. The lender’s underwriting department threw out all of the independent appraiser’s sales comps.

In addition to appraisals, another obstacle to a more robust recovery is negative equity. Most homeowners who bought in the last five years are underwater in value today, but some sellers want to list their home at a price they could have gotten at the height of the market. The problem of overpricing is evident when looking at the difference between average sales prices and original list prices. Three years ago, homes were selling for 95 percent of the original list price. Today they are selling for 83 percent of the original list price.

Many sellers argue in support of a higher list price because they think buyers will make a low offer. By listing high, the seller theoretically has more room to negotiate. The problem with that strategy is that sellers eliminate many buyers who might otherwise make an offer if the list price was closer to their price range.

The danger in overpricing right now is that June, July and August are the biggest closing months of the year and many national housing analysts including Case-Shiller warn that the second half of 2010 could bring another dip in home prices. They point to a continuing increase in foreclosures, which are accelerating more rapidly at the high-end of the housing market. Foreclosure website RealtyTrac recently reported a 121 percent year-over-year increase in foreclosure filings of homes valued at $1 million or more. Additionally, the 90-day delinquency rate on home loans worth more than $1 million hit a high in February of 13.3 percent, higher than the overall rate of 8.6 percent, according to real estate data firm First American Core Logic.

With this in mind, we have encouraged our sellers to be aggressive with pricing now as their best chance to sell for the highest price is in the next few months.