Yes, I’m going to stick my neck out here and identify this as “THE BOTTOM” of the down market trend for the East End since 3rd Quarter 2005, which marked the peak of activity for the number of home sales, while certain segments of the market continue appreciating for another 18 months. Having been a student of these markets for almost 30 years, identifying changes and trends is always interesting. The stock market crash of 1987 didn’t hit full impact on the East End until 1990, thus 3 years of downward trend followed by 18-24 months of clawing our way to a healthy, balanced market. Two recessions and several advances later, we find ourselves establishing a floor to the worst correctionary market I’ve ever experienced. A floor is established when prices begin to find their new levels.

This Town&CountryMarket Report, 2nd Quarter 2009, actually reflects 1st Quarter activity. As mentioned in prior reports, Real Estate market analysis has a 3 to 6 month delay from the actual sales activity. Once again, this is due as a result of the time from the O&A (offer and acceptance); to contract issuance; then signing; followed by due diligence (i.e. survey, title, C of O update, mortgage approval); then, the actual closing of title followed by the recording of title transfer – after which, I can finally analyze the data and bring you the report- 3-6 months later, which is vastly different than business reports from retail sectors which is easily tracked within days.

Being in the trenches daily gives me additional insight into lead activity, which precedes the O & A activity- all of which is factored into my assessment of this as the “THE BOTTOM”

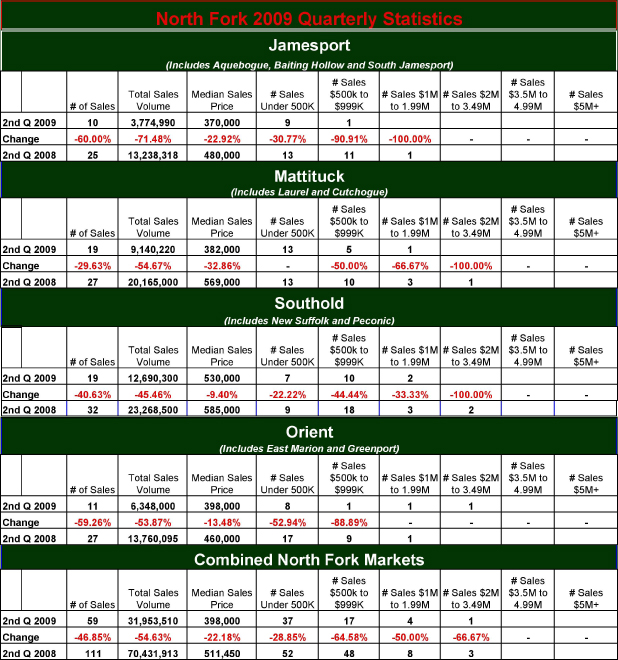

The bottom of the North Fork was a deep cut for all markets, but JAMESPORT (includes Aquebogue, Baiting Hollow and South Jamesport) saw a 71.5% decline in Total Home Sales Volume from $13.2M to $3.8M and only 10 sales in3 months, depicting the deepest cut. MATTITUCK (includes Laurel and Cutchogue) seems to have suffered the least with 19 closings in 2nd Quarter2009 vs. the 27 in 2008. But a look at 2007 2nd Quarter report by Town & Country showed 57 sales in MATTITUCK (includes Laurel and Cutchogue) — quite a radical change from 57 (2007) to 19 (2009)closings.

SOUTHOLD (includes New Suffolk and Peconic) experienced the least decline in Median Home Sale Price from $585,000 in 2nd quarter 2008 to $530,000 2nd Quarter 2009 or –9.4%. Again though, reviewing 2nd Quarter 2007 in prior Town & Country reports we see SOUTHOLD’S Median Home Sales Price in 2nd Quarter 2007 was $535,000—a virtual standstill.

Looking to all NORTH FORK MARKETS COMBINED we see the Number of Home Sales dropped 47% from 111 in the 2nd Quarter 2008, to 59 in the 2nd Quarter 2009 (and 154 in 2007). Additionally, the Total Home Sales Volume slid from $70.4M to $32M or a 54.6% drop, a far cry from 2007’s 2nd Quarter total sales volume of $104M.

There is a silver lining – at Town&Countrywe have experienced a healthy amount of sales activity since May. These appointments are turning into offers; offers into deals; deals into sales; and these sales will begin to assist the market in establishing

a floor! Next quarter Town & Country’s report will look much better, I promise!

To view more specifics on your particular locations and price ranges visit our website 1TownandCountry.com and click on “Reports”.