2012 Executive Summary

2012 Executive Summary

By Tim Estin mba, gri | www.EstinAspen.com | Broker Associate |Mason Morse Real Estate - Aspen

The purpose of this report is twofold: 1) report on the 4th Quarter 2012 Aspen Snowmass real estate market; 2) report market performance for the year 2012. The report documents sales activity for the 4th Quarter 2012 and Year 2012 for the upper Roaring Fork Valley - Aspen, Snowmass Village, Woody Creek and Old Snowmass - for all residential property types sold over $250,000. Fractionals are not included.

Total Aspen Snowmass Market*

4th Quarter 2012

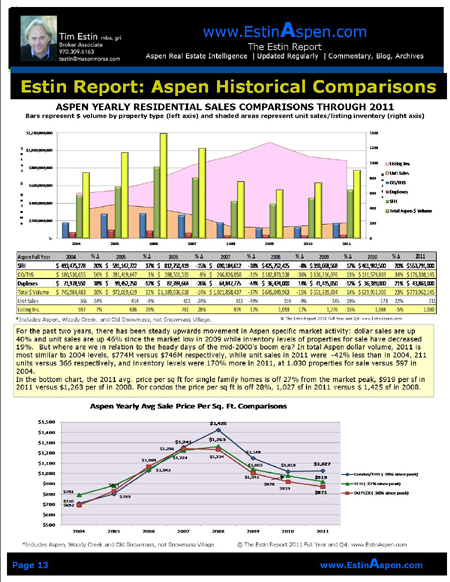

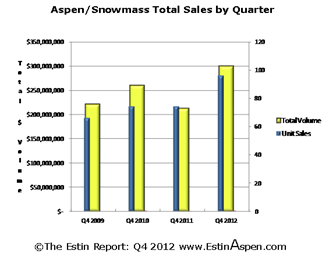

In the 4th Quarter 2012 (Oct. 1st - Dec. 31), total dollar sales volume was up 41% and total unit sales were up 30% over the 4th Quarter 2011 for the total combined Aspen and Snowmass Village real estate marketplace. Anticipated 2013 changes in capital gains, gift and estate tax laws motivated a number of transactions before the end of the year and outweighed uncertainty caused by the fiscal cliff debate.

This has been the strongest performing 4th Quarter of the past four years. Aspen single family home sales, accounting for 59% of total market dollars, were especially strong, up 65% in dollar sales and up 41% in unit sales during the 4th Quarter over the same time last year.

Prior Year 4th Quarter Comparisons

Q4 2012: · $300M (+41% from Q4 2011) · 96 unit sales (+30% from Q4 2011) Q4 2011: · $213M dollar sales (-18% from Q4 2010) · 74 unit sales (+0% from Q4 2010) Q4 2010: · $260M dollar sales (+18% from Q4 2009) · 74 unit sales (+12% from Q4 2009) Q4 2009: · $221M dollar sales · 66 unit sales

Q4 2012: · $300M (+41% from Q4 2011) · 96 unit sales (+30% from Q4 2011) Q4 2011: · $213M dollar sales (-18% from Q4 2010) · 74 unit sales (+0% from Q4 2010) Q4 2010: · $260M dollar sales (+18% from Q4 2009) · 74 unit sales (+12% from Q4 2009) Q4 2009: · $221M dollar sales · 66 unit sales

*Includes Upper Roaring Fork Valley: Aspen (with Brush Cr. Village, Woody Creek and Old Snowmass) and Snowmass Village combined with all residential properties and vacant land over $250,000. Fractional sales are not included.

2012 Year

In 2012, the total Aspen and Snowmass Village combined dollar sales volume of $972M was approximately even with 2011 at $967M, 0% change, and unit sales, at (333) sold properties, were 7% above 2011 with (310) sold properties. The inventory of total active listings for sale, the measure of supply, at (1,695) in 2012 decreased 4% compared to (1,774) in 2011 and has fallen 22% from (2,167) properties for sale at its peak in 2009.

2012 was characterized by a slow first six months of the year due to lack of snow, a sputtering national economy, Euro financial woes and pre-election paralysis. Contrary to years 2009 - 2011 which experienced strong first halves only to fizzle out later in the year, 2012 sales started slowly in the first half, gained strength in the 3rd Quarter 2012 based on solidifying Aspen single family home sales and surged towards the Q4 yearend.

Big Ticket $10M+ Sales In Q4 2012, there were (7) sales of Aspen homes over $10M totaling $101M; in Q4 2011, there were (3) such sales totaling $52M. For all of 2012, there were (16) sales of homes over $10M totaling $234M - (5) of these sales occurred in H1 2012 and (11) took place in H2 2012; for 2011, there were (19) sales of homes over $10M totaling $291M of which (15) of these sales took place in the H1 2011 and (4) took place in H2 2011. In the over $10M sold home category, 2012 experienced a slow start, big finish whereas 2011 was the opposite, a big start, slow finish.

Aspen Single Family Homes In Q4 2012, sales of Aspen single family homes were up 65% in dollar volume to $201M from $122M and 41% in unit sales to 31 sales from 22 over the same period last year. Single family home pricing pressure appears to have turned a corner in the 4th Quarter: median prices, generally a more accurate indicator of pricing trends as average prices can be skewed disproportionately by very high or low sold prices, rose a startling 33%, to $5.3M in Q4 2012 from $4M the same time last year; single family home price per sq ft increased 10% to $1,128 sq ft in Q4 2012 from $1,024 sq ft in Q4 2011 arresting the downward trend of the past 4 years.

For the year 2012, these price increases are less dramatic and likely more realistic. Aspen single family home median prices are up 8% to $4.3M from $4M in 2011... and price/sq ft is up 10% to $1,062 in 2012 from $963 in 2011 suggesting prices have at least stabilized and downward pressure has eased.

Aspen Condos

In Q4 2012, Aspen condo unit sales were up 22% from the same period in 2011, (28) sales now versus (22) then, and dollar sales volume was up 8% to $42M in Q4 2012 versus $39M same time 2011.

For the year 2012, Aspen condo sales were off 15% in dollar sales to $149M from $176M in 2011, but up 11% in unit sales to (104) units sold versus (94) in 2011. In terms of pricing, Aspen condos are not yet out of the woods: for 2012 the key condo metrics -the average price ($1.4M, down 23%), median price ($847K, down 29%) and price per sq ft ($946, down 10%) - were all lower than 2011.

Unless a condo is new or in like-new remodel condition, buyers are moved by value primarily and/or by unique location and attributes such as top floor/vaulted ceiling/corner unit on the river. "New or newer" and the best deals sell, all others sit on the market.

Vacant Land Sales Surging

There has been a dramatic increase in vacant land sales in 2012. Typically, when land sales start to pick up, it is a marker of a market transition, a tipping point.

For the year, vacant lot sales increased 149% to $84M from $34M in 2011; unit sales - the number of residential land sales - increased 107% year over year. These increases should be even higher in that the numbers do not reflect the sale of older teardown properties which show up in the MLS as residential property with improvements rather than vacant land.

Demand for land has accelerated for a number of reasons: generally lower land prices; the low cost of capital; more competitive construction bidding (reducing building costs more on the labor side than materials side); reduced development times to build as the Pitkin County approval process has shortened to approximately 18-24 months now from 24-36 months during the boom days; and finally, the absence of new-built product.

As written numerous times in The Estin Report in the past 1-2 years, there is presently a vacuum in the marketplace of new built residential product, and anything new - whether brand new or significantly remodeled, homes or condos - has been selling relatively quickly at premium pricing.

Buying land and building new offers a good hedge against any lingering market uncertainty and the slow pace of an improving marketplace. By the time one completes construction of a new Aspen home, demand for this scarce 'new' product should continue to be high, supply low and premium pricing a realistic outlook - unless construction takes off significantly in the next 1-3 years and new built properties flood the market. Snowmass Village Snowmass Village real estate represents 12% of the total dollar volume of the combined Aspen Snowmass market. While consistent annual sales gains have been a struggle for the past 3 years, sales have improved overall since the darkest days of 2009. In 2012, dollar volume increased 27% to $121M from $95M in 2009, and unit sales have increased 129% to (78) closings in 2012 from (34) in 2009. But, for some perspective: while Snowmass dollar sales in 2012 were $121M, this is 29% of the $419M dollar sales of the 2005 Snowmass peak selling year; and unit sales in 2012, at 78, were 30% of the 259 unit sales of the 2005 Snowmass peak.

The resort in general is mired in pre-2004 sales activity levels with continued significant pressure on sales and prices.

SMV Single Family Homes

In Q4 2012, there were (7) home unit sales versus (5) in Q4 2011, up 40%; the dollar volume increased 29% to $18.4M from $14.2M in Q4 2011. As the sales base is so low, the significance of these actual numbers should not be over-rated.

Price pressure continues: in Q4 2012, median home prices fell 30% to $1.85M from $2.65M in Q4 2011. Price per sq ft fell 4% to $644 from $673 in Q4 2011.

For the year 2012, SMV home sales are down 31% in dollar volume although down just 4% in unit sales versus 2011. Falling average and median prices, decreasing sold price per sq ft, and sharply rising listing days on market, is the result of too much inventory chasing too few buyers...that supply continues to outpace demand. Call it denial, call it disconnect, but this sobering reality can be difficult to acknowledge—a case in point: in The Pines/Two Creeks areas - known for beautiful 5500-6500 sq ft, mid-2000 built, ski-in/ski-out family homes, there are currently (12) homes for sale between $6.8M-$11.9M at an average $1,492 sq ft ask price; yet in 2012, the (5) homes that sold in this area sold at $1,082 sq ft., 27% less than current ask price/sq ft.

The average price per sq foot of a single family SMV home at $677 sf now is off 52% from its 2007 peak of $1,424.

SMV Condos

Continued condo sales pressure remains and perhaps even more so: in late November 2012, The Viceroy initiated a new sales program for its 2010 built condos (the newest built condo product in SMV) reducing prices 60% from their 2006/2007 peak pre-construction prices. These condos had been tied up in litigation for the past 2-3 years and were unavailable. Recently, a 2 bdrm/2 bath, 1,123 sq ft furnished Viceroy unit closed 12/19/12 at $1.2M/$1,069 sq ft. This large supply of like-new, albeit hotel-like condo product, puts pressure on all other older SMV condo listings.

For condos, the avg. price per sq ft is now $608 sf, down 43% from the 2007 peak of $1,055 sq ft.

Since the middle of Q3 2012, SMV condo unit sales have begun to trend upwards. A sense of optimism is growing due to significant positive development initiatives taking place at the resort (details on next page), and it is positive to note that SMV is just starting its primetime 2013 winter/spring selling season.

SMV Good News Unbelievable deals are to be had in Snowmass Village and buyers are urged to investigate the highly discounted property opportunities in this beautiful area so close to Aspen.

Tim Estin is an active Aspen Snowmass real estate broker and he welcomes your comments, inquiries and business. Email him This e-mail address is being protected from spambots. You need JavaScript enabled to view it or call 970.920.7387. Subscribe to The Estin Report and blog on twitter @EstinAspen

Disclaimer: The statements made in The Estin Report and on Tim Estin's blog represent the opinions of the author and should not be relied upon exclusively to make real estate decisions. A potential buyer and/or seller is advised to make an independent investigation of the market and of each property before deciding to purchase or to sell. To the extent the statements made herein report facts or conclusions taken from other sources, the information is believed by the author to be reliable, however, the author makes no guarantee concerning the accuracy of the facts and conclusions reported herein. Information concerning particular real estate opportunities can be requested from Tim Estin at 970.920.7387 or by email.. The Estin Report is copyrighted 2010 and all rights reserved.. Use is permitted subject to the following attribution: "The Estin Report: State of the Aspen Market, By Tim Estin, mba, gri, www.EstinAspen.com"